Approximately 2.5x estimated reward/risk ratio

Shutterstock represents one of the best IRR opportunities in the market right now. I have a downside estimate at 19 dollars which is approximately their pre-merger valuation but an upside if 28.80 which is the cash value shareholders in Getty could elect for in lieu of stock or a cash-stock mix. The deal is set to close before year end which could mean a 30% return over approximately 3-4 months.

Shutterstock is: business model

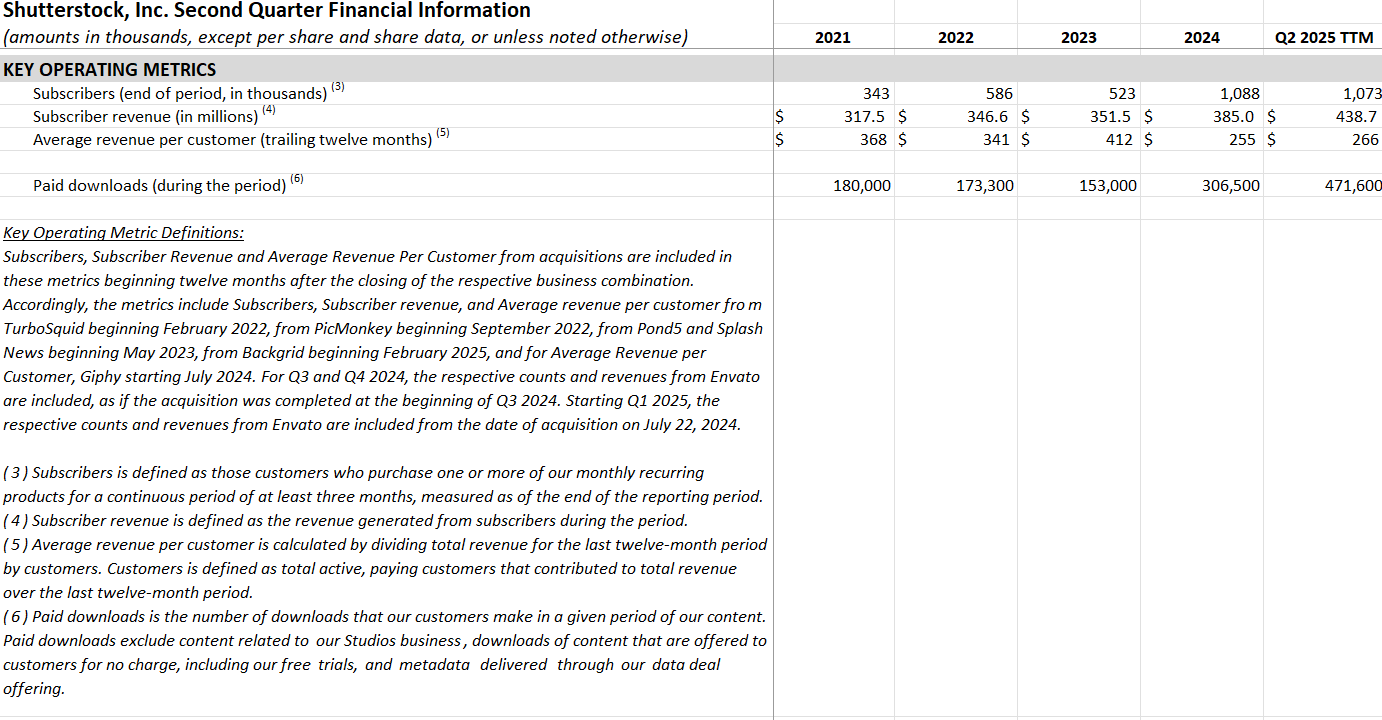

Shutterstock makes most of its money through subscriptions, one time purchases, and licensing of stock photos, videos, and music. Photographers and musicians sell on Shutterstock and get paid when it sells. They control over half of this market and it makes up approximately 80% of revenue

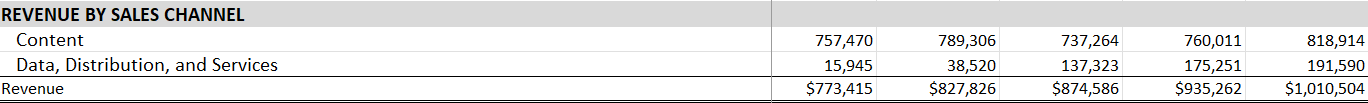

An emerging growth vector for the business is the sale of metadata to AI businesses complimented by customized content and advertising solutions.

The way I view the transformation is like this: the company is still the dominant player in stock media. And for several animators, photographers, and artists, Shutterstock can still be a promising way to monetize. This will ultimately be a declining revenue stream on an organic basis. But that revenue can be reinvested through the data-distribution-services side.

Metadata: a brief detour to describe the business of selling metadata. First, metadata describes the DESCRIPTIONS of an asset, tags, captions, keywords, licensing rights, user engagement and more. Essentially because AI models are reliant on knowing WHAT something is as much as knowing that it is the business can be incredibly lucrative, especially as Shutterstock already has that data. They already have contracts with OpenAI and other AI companies bringing in over 140 million dollars annually and growing at a roughly 30% clip. Essentially in order for Dall-E, the image and video generator created by OpenAI to improve, Shutterstock is an invaluable asset to continuously receive data, and in this way they reorient their business to prevent losses from AI competition.

The other aspects of this come from the creative and advertising side. GIPHY was acquired from Meta back in 2021 and their ads platform creates a diversified revenue stream while the acquisition of Envato in 2024 boosts their offering in their Studio group where unlike Canva or Adobe that lean into tools and simple DIY Shutterstock is targeting end-to-end enterprise solutions where they do everything for you. I am not commenting on if the strategy is better or worse, but it is differentiated which can allow them to be profitable through specialization.

All of that to say I think people underestimate the strength of Shutterstock as a standalone business. There are concerns that the traditional internet companies will be thrown out of business by AI. Shutterstock is being proactive and realizing that their metadata can create serious competitive advantages for them while taking their creative agency in a less-disruptable direction.

I think the best way to get “the bull case” on a stock is to look at the company’s investor presentations and check their statements against reality. I always love seeing these presentations because you can sus out what the plans are internally and develop a B.S. detector for when management is just being promotional.

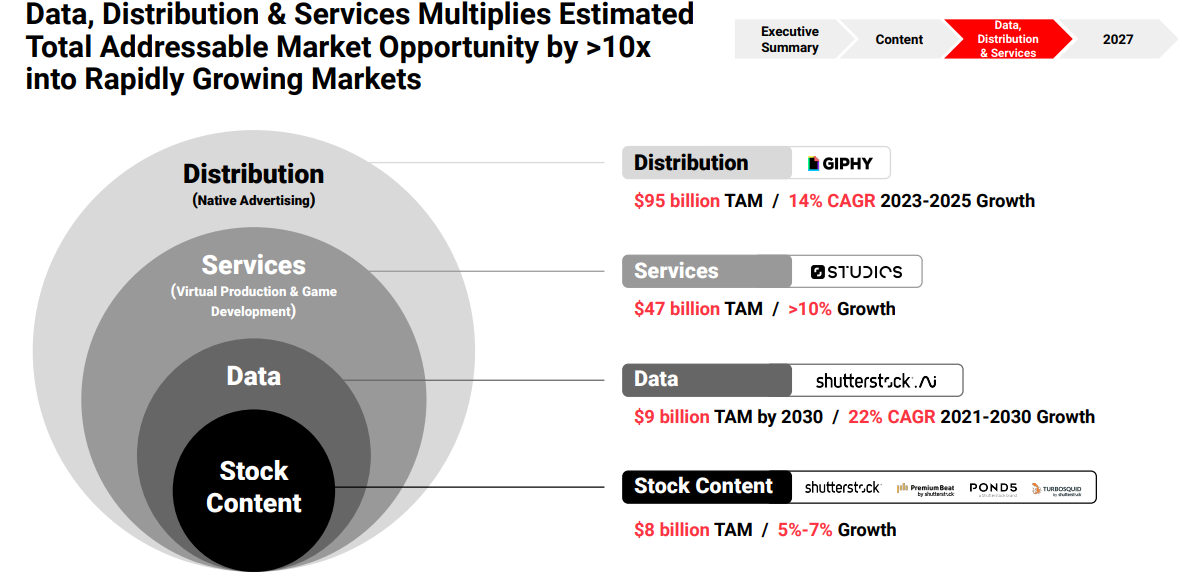

February 2024 management released a Shutterstock 2027 presentation where management guided for full year 2027 revenues of 1.2 billion and 350 million in adjusted EBITDA, which, using an estimate to convert adjusted EBITDA into standard EBITDA I have 260 Million or approximately 3.7x EV/2027EBITDA.

The slides below also show how the company intends to drive this growth-which runs contrary to the popular market view of the business.

The Envato acquisition was completed the next quarter and increased exposure to subscription revenue, doubling subscriber count. It also increases exposure to audio, video, and 3D instead of stock photos. With the acquisition and recent quarterly results I think it is incredibly feasible for the business to hit 2027 targets.

Fundamentals: I think looking at Shuterstock starting in 2020 makes sense, the GIPHY acquisition was in 2021 plus it gives us a pre and post AI timeframe. The company has had a revenue CAGR of over 8% but continues to innovate on ways to prolong the business which has deflated margins over time. My estimate is that mid-cycle gross margins have decreased by about 200 basis points from approximately 60 to approximately 58. You see about a 300 basis point decrease in operating margin and about a four hundred basis point decrease in net margin. For the balance sheet there is very little to worry about, the company has flipped from a net-cash to a net-debt position since 2024 Debt to equity is approximately 0.5 and debt to mid cycle EBITDA is just under 2X. Meanwhile, shares outstanding stays mostly stable. The real disconnect is in the cashflows

Since 2021 the business has made several acquisitions. These acquisitions have suppressed free cash flow over time but with no new acquisitions so far in 2025 and the acquisitions from previous years integrated the company is back to FCF yields in the mid teens. Meanwhile their price to sales is significantly lower than any time in the last 5 years, and it trades at an EV/EBITDA of less than 7. This is with returns on capital that, while exceeding costs of capital, are under their mid-cycle averages. All of this whale maintaining a dividend roughly equating to a yield above 6%

Getty merger in January of this year Getty Images announced an intent to merge with Shutterstock. Getty is easily the largest direct competitor in the space, typically focusing on higher-end curation and taking a more hands on approach to AI development compared to Shutterstock’s partnership approach. However, the two of them together would undoubtedly create the largest provider of stock-media on the planet. Getty is more highly-levered but the idea is that by combining operations the two businesses can cut down on SGA expenses to the tune of 150 million in savings per year. The deal has 3 potential payouts, an all cash offer for Shutterstock shares of $28.85 per share or 13.67 Getty shares or a mixed consideration of $9.50 + 9.17 shares. I am a simple man. Even after a spike on Friday the 22nd the all shares consideration is still below the all cash offer. Let's assume on Monday Shutterstock trades for approximately $22 dollars per share and the deal closes in December of this year. That would be a 31% return on the cash offer in 4 months, just shy of a 100% IRR. But that obviously comes with some risks.

The biggest one is the deal not closing. The good news is shareholders from both sides have approved, but even I have to admit this thing looks like a monopoly. Whether or not Andrew Ferguson, Trump’s replacement for Lina Khan will be as anti-merger as he appears is yet to be seen. The acquisition of US Cellular by T-Mobile was approved, which again, looked very monopolistic. Ferguson is particularly harsh on big-tech firms, however, the FTC has failed to take any substantial action here. However, I am more concerned about the UK regulators. The UK has historically been a bit more harsh here, and they have begun their probe into the deal with a decision deadline for October 20th.

Of course you also have all of the other “Caveat emptor” you can tell are lying because their lips are moving that management uses to justify deals, but that is not my suggestion here. To me, buying Shutterstock at these prices means having a downside at roughly 19 and an upside at roughly the cash offer mark. Under a worst-case scenario you see Shutterstock retrace their 14.50 lows of the liberation day selloff, at which point they will be trading at roughly 4.5x forward EV/EBITDA, 30% insider ownership, a nearly 8% dividend yield, and all of the previously mentioned facts. So I call this one unlikely. Even if the merger fails, I do not think a $30-dollar 2027 price target is unreasonable, considering that is where Shutterstock was trading BEFORE the merger. If fundamentals continue to improve due to the AI pivot and the pausing of new acquisitions, an aggressive estimate puts the business closer to 45 dollars. But my base case of 14% downside vs 31% upside gives this idea a 2.2X Return/risk asymmetry. I consistently look for >2X R/R ideas. And this is one of the most interesting on the market.

An interesting, straight facts write up! Currently in the process of research on the trade here, but if I end up allocating to it, will definitely make my own write up and reference this article. Thanks!